Overspending is a challenge many people face, often leading to financial strain and difficulty achieving savings goals. Fortunately, several apps are designed to help you control your spending habits, manage budgets, and save for the future. Whether you’re looking for a shared budget app or the best app to keep track of spending, this guide has you covered.

Is There an App to Stop Spending Money?

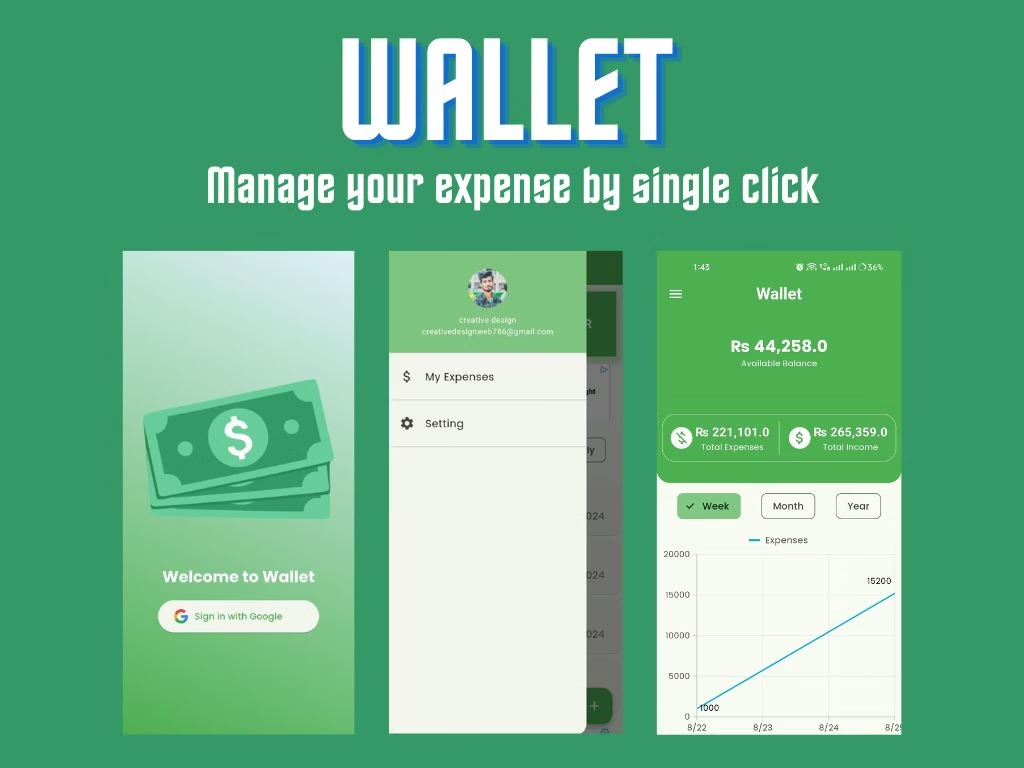

Absolutely! Plenty of apps are designed to help you keep your spending in check. They track your purchases, analyze your financial habits, and even set limits to prevent overspending. One such app is Wallet: Track Expense & Income, which provides detailed insights into your spending patterns. With Wallet, you’ll have all the tools you need to make smarter financial choices.

What Is the Best App to Keep Track of Spending?

If you’re on the lookout for the best app to track your spending, Wallet: Track Expense & Income is hard to beat. It’s user-friendly, allowing you to easily log expenses, organize them into categories, and set monthly budgets. Whether it’s your personal finances or shared household costs, Wallet helps you stay in complete control of your money

How Can I Reduce Excessive Spending?

Cutting down on excessive spending takes discipline, but having the right app can make it much easier. With Wallet: Track Expense & Income, you can set spending limits and receive notifications if you’re approaching them. The app also provides clear, visual reports of your spending habits, making it simple to spot areas where you can cut back.

Is There a Shared Budget App?

For those managing shared finances, finding the right shared budget app is essential. Wallet makes collaboration simple by enabling users to share budgets and financial plans with family members or roommates. This feature ensures everyone is aligned and avoids overspending in joint expenses.

How Wallet Helps You Reduce Overspending

Wallet isn’t just a basic expense tracker—it’s a complete money management solution. Here’s how it stands out:

Expense Tracking: Record every transaction to stay on top of your spending.

Budget Management: Set monthly limits and get notifications to avoid overspending.

Income Tracking: Monitor your earnings alongside expenses for a clearer picture of your finances.

Shared Budgets: Manage household or group expenses with ease.

Advanced Filtering: Use advanced filters to examine your expenses in greater detail.

PDF Generation: Download PDF reports of your expenses for easy sharing with family members.

With features like these, Wallet proves to be one of the best apps to reduce overspending while promoting better financial habits.

Read More

Why Apps to Reduce Overspending Are Essential

Money management apps have revolutionized personal finance. They not only help track expenses but also promote mindful spending habits. Wallet, for instance, empowers users to take control of their finances, making it easier to achieve goals and avoid financial stress.

Final Thoughts

Reducing overspending is possible with the right tools, and apps like Wallet: Track Expense & Income make the process seamless. Whether you want to monitor your daily expenses, collaborate on a shared budget, or simply develop better money habits, Wallet is here to help.

Download Wallet: Track Expense & Income today and take the first step toward smarter financial management!

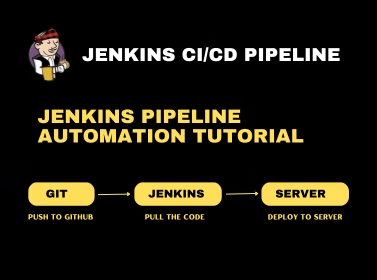

GitHub Integration with Jenkins on AWS EC2 (with Webhooks + Error Fixes)

Step 1: Install Java (Required for Jenkins) sudo apt update sudo apt install -y openjdk-17-jdk…

Five Best Budgeting App in UK

Keeping track of your finances can sometimes feel like a juggling act, especially when unexpected…

what is telecom expense management ?

Telecom Expense Management refers to the processes and technologies used by organisations to manage, analyse,…

Apps to reduce overspending in 2025

Overspending is a challenge many people face, often leading to financial strain and difficulty achieving…

Best Free Expense Manager App

Managing your money can sometimes feel overwhelming, but it doesn’t have to be. If you’re…

worried ? Control your budget by just one click

Managing your finances can feel overwhelming, especially when expenses pile up unexpectedly. But what if…