Keeping track of your finances can sometimes feel like a juggling act, especially when unexpected expenses pop up. With the rising cost of living in the UK, budgeting isn’t just a good idea—it’s a necessity. Thankfully, technology has made it easier than ever. Budgeting apps have become essential tools for anyone who wants to manage their money better. Let’s dive into some of the best budgeting apps in the UK and see why Wallet: Track Expense & Income should be at the top of your list.

Why Budgeting Apps Are a Must in the UK

The UK’s financial landscape can be unpredictable. From rising energy bills to fluctuating grocery prices and the ever-growing number of subscription services, keeping track of where your money goes can be a challenge. Budgeting apps simplify this process, giving you a clear and organized view of your income, spending, and savings goals. Whether you’re managing finances as an individual, a couple, or a family, these tools can make a world of difference in reducing financial stress and improving your financial health.

- GitHub Integration with Jenkins on AWS EC2 (with Webhooks + Error Fixes)

- Five Best Budgeting App in UK

- what is telecom expense management ?

What Is the Best UK App for Home Budgeting?

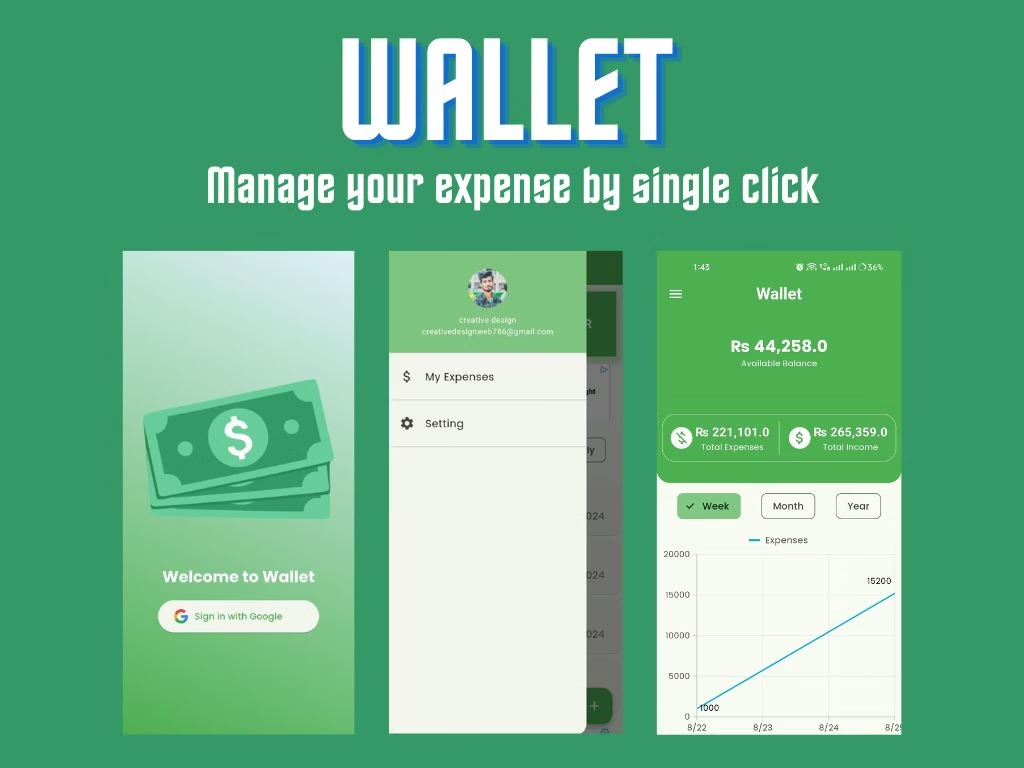

If you’re looking for the best app to manage your home budget, you need one that’s easy to use, feature-rich, and flexible enough to adapt to your needs. That’s where Wallet: Track Expense & Income comes in.

Here’s what makes Wallet stand out:

- Customizable Budget Goals: Set limits for your monthly spending and receive helpful reminders to stay on track.

- Effortless Expense Tracking: Easily categorize your spending into different areas like groceries, utilities, and entertainment.

- Detailed Reports: Get clear insights into your spending habits, helping you identify where to cut back and save more.

- Multi-Device Syncing: Perfect for individuals or couples who need to stay on the same page about their finances.

Top Budgeting Apps in the UK

Here are some of the best budgeting apps to consider, including Wallet:

1: Wallet: Track Expense & Income

Wallet makes managing your money simple and stress-free. Its user-friendly interface and comprehensive features make it the perfect app for UK users who want to track every pound. Best of all, it’s free to download on the Google Play Store. If you’re serious about taking control of your finances, Wallet is a fantastic choice.

2: Emma

Dubbed the “personal finance assistant,” Emma is a powerful tool designed to help you effectively manage your subscriptions, cut unnecessary expenses, and avoid costly overdraft fees. It has gained immense popularity among younger users who are eager to improve their financial literacy and budgeting skills in today’s fast-paced world.

3: YNAB (You Need a Budget)

YNAB, which stands for “You Need A Budget,” is an exceptional choice for users who are deeply committed to budgeting and taking control of their financial destiny. This robust app goes beyond basic expense tracking; it empowers you to create a tailored financial plan that reflects your specific needs and aspirations. While it operates on a subscription model as a paid app, the investment is well worth it due to its advanced features designed to foster better money management.

Additionally, YNAB offers educational resources and community support aimed at helping users develop essential budgeting skills. The app provides insightful reports that break down spending patterns over time, empowering users to identify areas where they can cut back or adjust their budgets accordingly. With YNAB’s intuitive interface and commitment to fostering financial awareness, it’s an ideal solution for anyone serious about creating lasting change in their financial life while achieving peace of mind regarding their budget.

4: Monzo

Monzo isn’t just a digital bank—it’s also an excellent budgeting tool that offers a variety of features to help you manage your finances effectively. With automatic spending categorization, users can easily track their expenses, and the innovative “Savings Pots” feature allows for effortless saving toward specific goals. This makes Monzo a solid option for those who want both banking and budgeting seamlessly integrated in one convenient place.

5: Cleo

Cleo takes a fun and interactive approach to budgeting, utilizing an intelligent chatbot that provides personalized financial advice and insights in real time. This innovative app transforms the often daunting task of budgeting into a more enjoyable experience by engaging users in conversation. Cleo’s conversational style makes it particularly appealing for younger audiences or those who appreciate a modern twist on traditional finance management.

The chatbot is designed to answer your questions about spending habits, suggest ways to save money, and even provide reminders for upcoming bills or payments. Furthermore, Cleo analyzes your financial behavior to offer tailored tips that help you optimize your budget based on your lifestyle. With features like gamification elements that encourage saving challenges and rewards for reaching goals, users find themselves more motivated to engage with their finances actively.

In addition, Cleo allows you to track expenses across various categories easily and offers insights into where you can cut back without sacrificing enjoyment in life. By combining technology with personal finance management in such an interactive way, Cleo not only helps users stay informed about their financial health but also empowers them to take control of their future spending decisions confidently. Whether you’re new to budgeting or looking for a fresh perspective on managing your money, Cleo provides the tools and support needed to make smart financial choices while keeping things lighthearted and fun.

Why Wallet Is the Best Choice for UK Users

While there are plenty of excellent apps available, Wallet: Track Expense & Income stands out as a top choice for UK users. It’s designed to be intuitive, comprehensive, and—most importantly—free. Whether you’re budgeting for your household, managing shared expenses with a partner, or saving for a big goal, Wallet makes the process simple and effective.

Start Budgeting Smarter Today

Budgeting doesn’t have to be a daunting task. With Wallet: Track Expense & Income, you can take control of your finances and build a better financial future.

Download Wallet: Track Expense & Income today and start your journey toward smarter money management.

Your financial freedom is just a tap away!

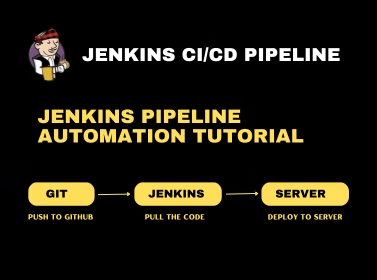

GitHub Integration with Jenkins on AWS EC2 (with Webhooks + Error Fixes)

Step 1: Install Java (Required for Jenkins) sudo apt update sudo apt install -y openjdk-17-jdk…

Five Best Budgeting App in UK

Keeping track of your finances can sometimes feel like a juggling act, especially when unexpected…

what is telecom expense management ?

Telecom Expense Management refers to the processes and technologies used by organisations to manage, analyse,…

Apps to reduce overspending in 2025

Overspending is a challenge many people face, often leading to financial strain and difficulty achieving…

Best Free Expense Manager App

Managing your money can sometimes feel overwhelming, but it doesn’t have to be. If you’re…

worried ? Control your budget by just one click

Managing your finances can feel overwhelming, especially when expenses pile up unexpectedly. But what if…